STAKEHOLDER INTERVIEWSPerspectives from 15 global health leaders on GHIT's catalytic role and

Japan's transformational contributions to global health R&D

FUNDING

02

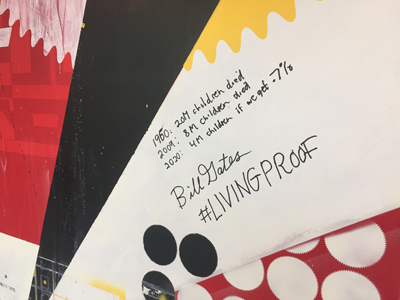

Dr. Hannah Kettler

Senior Program Officer, Life Science Partnerships

Global Health Program, Office of the President

Bill & Melinda Gates Foundation

“I think the big change, clearly in the last five years, is their decision to support the GHIT Fund and take the risk of doing that as a public-private partnership.”

In what ways is the Bill & Melinda Gates Foundation unique among science and innovation funders?

The Gates Foundation is unique because it is focused on outcomes and its goals are, ultimately, tangible global health products and outcomes. The Foundation is interested in seeing research turned into products that reach those most in need in developing world countries. At the same time, the foundation can leverage and complement other organizations that fund science, research, and science capacity.

The Foundation is also unique in that we take a long-term view and are prepared to take risks. We will often invest in a portfolio as opposed to individual products to address global health needs, with the expectation that there will be attrition. For example, because we are looking for a TB solution—not to fund a TB drug—we support several efforts. I think that differentiates us.

We are focused on identifying the best-placed organization or group of organizations —an academic researcher, a non-profit, and/or a company to do that work—and that flexibility and allowance to work with multiple different types of partners also makes us unique.

Finally, we have different tools at our disposal that give us flexibility in terms of the types of engagement we can have. We can make grants and make program related investments – equity investments, loans, volume guarantees – all in furtherance of our charitable global health aims. That toolkit differentiates us from some of the traditional science funders.

Traditional non-industry funders tend to have less flexibility in terms of the types of partners with which they can work, as well as the time frame and objectives of their research funding.

All of what I'm saying is in the context of the foundation's portfolio of priority diseases, which are diseases that disproportionally impact the poorest in developing countries: malaria, TB, neglected tropical diseases, pneumonia, different types of enteric diseases.

The funding gap in global health R&D is defined in various ways. How would you define that gap?

If you look at the landscape of different funders in global health—and R&D for health in general—there is a tendency to see a cluster of government funding at an early stage. When there's a market, investors or venture capitalists support companies' efforts to discover and develop good science and academic ideas into technologies or products that then, in turn, are often brought to market by multinationals. So, there's a continuum of public and for-profit investment.

Looking at that same landscape in the global health space, there are relatively large amounts of basic research funding. Many of the same organizations, like the NIH and the equivalent in other countries, are sponsoring research that's relevant to global health as well as other diseases. There are organizations like the Wellcome Trust that are prepared to explore how that research will look from a discovery standpoint. Traditionally, the problem was that at that point there was no one prepared to pull forward the science and early discovery ideas with promise to address global health needs, or products that may have been on the shelf, and fund them through to approval —because of a lack of a market incentive. The traditional private investors—the venture capitalists, the multinationals, and small biotech companies—typically weren't interested in global health work and moving that forward. So, while one could make a case for more funding for global health R&D all along the value chain, the largest gap is probably in the proof-of-concept through product commercialization phases.

We are uniquely focused not only on the best science and moving it forward but also on product outcomes and identifying the best partners.

How is the Gates Foundation is helping to bridge that funding gap?

The Foundation is not the only entity funding that transition, but we are uniquely focused not only on the best science and moving it forward but also on product outcomes and identifying the best partners. We focus on questions like: How do you get global health-related projects and products through the value chain? What's the best way to use and leverage our funding to also attract other public and private resources? How do you de-risk the perception of those opportunities for other investors that might be not only traditional donors, who tend not to fund research and development at all, but also the private investors that are reluctant to take the risk on something that's perceived to have such low return on investment? We're well placed to use our money, but we can't afford to pay for everything. So, the question is: How do we mitigate risks for other types of funders so that they can come in and do their part?

People talk a lot about needing companies in the mix because they're the best established as innovators in doing the work and ensuring that products ultimately reach the people who need them. But there's also real value in having for-profit investors involved from the standpoint of their ability to evaluate and manage risk and to oversee and assess the capabilities of the organizations and hold them accountable. Attracting other types of funders is of real importance, and that kind of engagement with the donors is the type of work that the foundation is well placed to do.

How have you seen the global health R&D innovation funding landscape shift over the past several decades? Why does the shift matter? What's possible today that wasn't 10 or 20 years ago?

In the late 1990s and early 2000s, especially foundations like Rockefeller as well as Gates placed importance on the development of new products, technologies, vaccines, and diagnostics through public private partnerships. Not too long ago, there was a sense that global health R&D was exclusively reliant on charity and luck, on the benevolence of individual sciences, or on companies doing something, such as a skunk project, or scientists working in suboptimal arrangements without access to the best technologies and partners. But that assumption changed in the mid-90s when the first product development partnerships (PDPs) were first funded—IAVI being the first in 1995—and there was a shift toward organizing partners, research, and research dollars around the development of global health products as opposed to the development of science.

Along with the development of those PDPs—and philanthropic funding coming into the mix and making global health a priority—perhaps even more important was the engagement of aid agencies that did not traditionally fund R&D. Unlike traditional research funders, e.g. NIH, aid agencies are focused on health/development outcomes and as product development portfolios become more outcome oriented, several them – USAID (United States Agency for International Development), UK's DFID (Department for International Development), and most recently Japan's MOFA via GHIT – started to invest in product development as well.

“What's exciting is that, beyond providing the pool of funding and putting Japan on the map for global health product development, GHIT's model has a requirement that there be global partnerships between Japanese and global organizations.”

Prior to that, these traditional aid donors hadn't matched the difference?

Not in product development. There is still tension within those departments about how to balance between support for product development and support the procurement and implementation of existing tools, of health systems, in-country capacity building, building up clinics, and investing in the competencies and government structures that make for functioning health systems. How do you balance between that and the development of future tools? As I said, the big transformational change was in the late 90s and early 2000s. Early leaders of the PDPs, such as Seth Berkley (founder of IAVI) and many others were instrumental in talking with USAID, DFID, and other traditional aid donors to get them to consider product development given the ultimate impact on health outcomes and economic development. Making that case meant convincing these agencies to risk longer-term timelines. I would say that's probably the biggest change.

What role has Japan played in changing this funding landscape?

I know Japan's role only from the GHIT Fund. My impression is that Japan was a latecomer to funding product development, even though it was a key player in global health more generally. Japan was instrumental in supporting The Global Fund to Fight AIDS, TB, and Malaria and had a very strong mandate to support health systems. While those things are all positive for health outcomes, Japan wasn't on the map as far as product-development funding was concerned. I think the big change, clearly in the last five years, is their decision to support the GHIT Fund and take the risk of doing that as a public-private partnership.

The way Japan co-funds with private investors, or private companies—pooling and leveraging private investment with their public—is different. There haven't been a lot of organizations that have made the availability of private capital a prerequisite for their donor funding—a precedent that hadn't been well established anywhere else.

The other thing is that prior to GHIT's establishment one could argue that Japan's R&D capacity was not realizing its potential impact on global health: Japanese companies, while on the Access to Medicine Index, were at the bottom of the Index. I think there was a perception that Japan was not exporting much of all that it knew how to do—the science, the capabilities—into the global network, the global institutions and ecosystem. What's exciting is that, beyond providing the pool of funding and putting Japan on the map for global health product development, GHIT's model has a requirement that there be global partnerships between Japanese and global organizations. This helps ensure both that what Japan is working on gets out and that companies can leverage and contribute to the existing global ecosystem. Companies are not expected to build up whole internal departments and capacity to work in global health.

In what ways, do you think that Japan is uniquely positioned to continue to transform the global health innovation funding landscape over the next five or ten years?

Japan is also a founder of the Coalition for Epidemic Preparedness Innovations (CEPI), a new partnership around vaccines and innovation for pandemic preparedness. This was on the G7 agenda for Japan, and the government followed through with a significant investment in a new R&D-based model. Japan has a reputation for taking on issues, and spearheading change. GHIT is a primary example. The Japanese government's use of its role as a leader among other governments, for example at G7, G8, and G20, is especially important now when a lot of questions are being raised about donor aid as an efficient use of government funding. So, through the increase in GHIT funding as well as the contribution to CEPI, a global fund, Japan is following through by walking the walk, not just talking the talk.

“We see GHIT as a vehicle through which the combination of Japanese government financial resources and company capabilities and their own financial resources can translate into real progress for our portfolio for global health priority products.”

The Gates Foundation is a funder and a founding partner of GHIT. Can you talk a little about the Foundation's hoped-for return on that investment?

As I mentioned earlier, the Foundation invests in outcomes, not just capacities. We see GHIT as a vehicle through which the combination of Japanese government financial resources and company capabilities and their own financial resources can translate into real progress for our portfolio for global health priority products.

I realize GHIT is also a mechanism for bringing academic scientists' and companies' earlier-stage research into the global health community. It's a bet on the impact that that research and science can have on solving our global health challenges. While we welcome the availability of compounds and some of the work that has been under way, the real question here is whether by bringing Japanese pharma companies into the PDP and global health landscape there might be an opportunity to bring them in as longer-term partners as some of their early projects start to advance. Although that's our hope, it's a little out of GHIT's scope, and it's not a requirement that they do that.

The Japanese companies are staying with projects as they go through one, two, or three rounds of GHIT funding. I'm quite optimistic that, at least in individual product examples, there will be continuity. I think a big deal is maintaining a relationship between the project, the team that has the real know-how, and the partner that's helping advance it. We have an expectation that that will be facilitated through GHIT.

Has GHIT made it easier to partner with Japanese entities on global health R&D?

I think that has certainly been the case. Partnering with Japan was not easy in the early days of the PDPs. At the outset of GHIT, there was, inevitably, a whole bunch of stuff on the shelf, which allowed for quick wins. The global pharmaceutical companies were making compound libraries available for screening, and the Japanese industry members of GHIT have partnered with some of the PDPs to make the Japanese compound libraries available, and brought resources in very quickly. Beyond that, I think we'll have to see.

One example that demonstrates the need to do more than just have RFPs was in the Gates Foundation Grand Challenge, where the Foundation has an interest in figuring out how to tap into the science capabilities and the entrepreneurs of Japan. I think what GHIT learned by offering to be a sponsor of the Grand Challenge Explorations in the first round was that just offering RFPs isn't sufficient. It involved going in and translating—not just language-wise but also in terms of “How does this work?” Maybe we all underestimated a little bit the investment required to create and support new networks of researchers responding to and participating in global RFPs.

The availability of the funding in and of itself in some of that early research wasn't enough, and GHIT is now following up to do much more active training and engagement with scientists, entrepreneurs, and researchers to help enable their excitement about the opportunity to participate.

“Working with GHIT—and the fact that GHIT exists—has enhanced the relationship between the Gates Foundation and the Japanese government as well as the Japanese partners.”

Has the Foundation's partnership with GHIT influenced the Foundation's partnership with Japan?

We have work with JICA on a couple innovative financing initiatives to support polio eradication and have engaged with the government as part of multilateral partnerships such as Global Fund and GAVI. Working with GHIT and GHIT's establishment has certainly enhanced and increased the quantity and quality of our engagement. It's brought companies into view that we weren't working with before and has opened doors that way.

Perceptions in the past were that global health R&D wasn't of interest to Japan. Working with GHIT—and the fact that GHIT exists—has enhanced the relationship between the Gates Foundation and the Japanese government as well as the Japanese partners.

What do you see as the relationship between GHIT and Japan's status as an innovation leader?

The volume of activity over the few years since GHIT was launched has raised attention with respect to Japan's potential role as sponsoring innovation in global health. Figuring out how to advance the portfolio is obviously the Foundation's primary interest, and so as GHIT goes into its next phase I think eyes will be on whether they will be able to sustain the engagement of the private sector through the RFPs as the portfolio of projects matures. Will the companies continue to participate in the projects? Will there continue to be new proposals from the same or different companies or researchers? At the outset, you have a pent-up supply of potential participants, but at some point, after those original top one hundred have been tapped, you might need to start working harder to solicit good proposals.

A challenge for GHIT is to continue to manage expectations about their ability to generate “health impact”. GHIT is a funder of R&D; they have successfully executed several RFPs and thus a sizable portfolio of projects, but those projects are spread across diseases and products. They do not yet have a large enough portfolio to be assured a win given the laws of attrition in product development and the fact that they tend to rely on co-funders – i.e. are not fully funding projects. That said, we are optimistic as several projects are advancing well—and that is a tribute to the organization and the scientific advisory committee in the selection process.

I do think that GHIT has put Japan on the map as an important global health funder and partner across several PDPs thereby elevating visibility of the government of Japan and the Japanese companies as partners in global health R&D.

“The success of what Japan does is very much related to how Japanese assets and other things are integrated into a global construct.”

Speaking of partners, you've facilitated and led the charge in a lot of partnerships for the Foundation. You played a major role in the London Declaration on Neglected Tropical Diseases. Do you have an archetype in your mind of what successful 21st century R&D partnerships for global health look like?

I certainly think the openness of different partners to recognize each other for who they are – their motivations, their limitations – is critical. This means investing the time to understand the business models of the companies and the other partners and then align and modify your concepts for what incentives might work to improve global health with what you learn about their business models.

An outcome of the foundation's and our partners' work over the past years has been to figure out how we can be more impactful with our funding. You can offer to subsidize the cost of doing product development, but that may not be enough or even relevant for some organizations. Companies might say: "Hey, we've got plenty of cash, but for us the big issue is that the markets are really uncertain. Or we are not malaria experts and don't know how to apply know how to malaria. Or, we've never done clinical trials or worked much in Africa. The clinical development and regulatory pathways are a total mystery to us.”

When you invest in understanding the set of risks, then you can build collaborations around bringing the appropriate tools to the table in that conversation. If you take the London Declaration as an example, that was a place where many companies already had their own programs but they lack a strong platform on which to stand as an industry together with other partners. The platform is important to demonstrate what they are doing, how their contributions fit with others to realize impact, where the remaining gaps were and what potential next steps were for the companies, other partners or both. Such collaboration involves bringing the different partners to the table united by a shared goal, to figure out "How do we solve this together?"

Today (as opposed to 20 years ago), we have a broader toolkit of incentives, financial and otherwise, from which to draw to help de-risk global health opportunities for companies These tools help enhances the ability to build coalitions, including companies, to focus on addressing the health needs of the poorest in developing countries.

Looking ahead now over the next five years, what are your hopes and expectations for the role Japan will continue to play in helping to transform the global health innovation funding landscape?

I do hope and have expectations that the Japanese pharma companies will seek out and be proactive in thinking about "What else can we do for global health?" Some companies are probably in that league, and others are thinking through what—beyond the individual projects—they can do, what kind of footprint they as a company can they have in global health broadly, and how they can work in global health to have a real impact.

The role of the CEOs is also a critical piece. Good partnership requires full commitment at the leadership level that empowers their teams within the organizations to prioritize and commit time to global health work. In the case of GHIT, I see CEOs investing time and attention to their role as members and take pride in it. As leadership turns over, I hope there will be continuity in the importance placed on the global health work.

As for the government, they have demonstrated the importance of investing in global health product development systems through their support of GHIT. The success of what Japan does is very much related to how Japanese assets and other things are integrated into a global construct. Japan has a role amongst peers on the G8 and G20 to reinforce the importance of that message.

How would you summarize the most valuable contributions of GHIT?

In a word: leverage. Leveraging across the different funders, and Japanese expertise and global health R&D capabilities. The philanthropic, for-profit, and government triad is an extremely valuable partnership that differentiates GHIT from lots of other organizations in terms of both their role in governance and their optimization of each other's capabilities and funding.

The affiliations and positions listed in this interview are at the time of publication of the interview in 2017.

- Biography

- Hannah Kettler, PhD, is Senior Program Officer for Life Science Partnerships in the Global Health Program at the Bill and Melinda Gates Foundation. She is responsible for a portfolio of grants and projects that aim to secure adequate financing and a supportive policy environment for global health product innovation and introduction. Before joining the Gates Foundation, she led a major project on biotechnology and international health at the University of California, San Francisco, and worked as the Senior Industrial Economist for the Office of Health Economics in London.

STAKEHOLDER INTERVIEWSARCHIVES

FUNDING

-

01

Dr. Naoko YamamotoSenior Assistant Minister for Global Health,

Ministry of Health, Labour and Welfare

#

-

02

Dr. Hannah KettlerSenior Program Officer, Life Science Partnerships

Global Health Program, Office of the President

Bill & Melinda Gates Foundation

#

-

03

Prof. Stephen CaddickDirector, Innovations Division,

Wellcome Trust

#

DISCOVERY

-

01

Dr. David ReddyCEO

Medicines for Malaria Venture (MMV)

#

-

02

Mr. George NakayamaRepresentative Director,

Chairman and CEO

Daiichi Sankyo Company, Limited

#

-

03

Prof. Kiyoshi KitaProfessor Emeritus, The University of Tokyo

Professor and Dean, Nagasaki University School of Tropical Medicine and Global Health

#

DEVELOPMENT

-

01

Mr. Christophe WeberRepresentative Director, President and CEO

Takeda Pharmaceutical Company Limited

#

-

02

Mr. Yoshihiko HatanakaRepresentative Director,

President and CEO

Astellas Pharma Inc.

#

-

03

Dr. Nathalie Strub WourgaftMedical Director

Drugs for Neglected Diseases initiative (DNDi)

#

ACCESS

-

01

Dr. Jayasree K. IyerExecutive Director

Access to Medicine Foundation

#

-

02

Mr. Tetsuo KondoDirector

United Nations Development Programme (UNDP)

Representation Office in Tokyo

#

-

03

Dr. Aya YajimaTechnical Officer

Malaria, other Vectorborne and Parasitic Diseases Unit

Division of Communicable Diseases

World Health Organization Western Pacific Regional Office

#

POLICY

-

01

Dr. Mark DybulFormer Executive Director

The Global Fund to Fight AIDS,

Tuberculosis and Malaria

#

-

02

Dr. Seth BerkleyCEO

Gavi, the Vaccine Alliance

#

-

03

Hon. Prof. Keizo TakemiMember of the House of Councillors of Japan

Chairman, Special Committee on Global Health Strategy

of the Liberal Democratic Party's Policy

#